In this edition, we cover all things rlBTRFLY! We’ll be going over what to expect on the other side; and how to lock up, use the new BTRFLY token, understand its moving parts, and explore its use cases.

If you are reading this, then the long awaited day is upon us! rlBTRFLY is HERE!!!

On August 8, the Redacted announced the launch of v2 BTRFLY!

To get a better understanding as to why this is so important and what to expect in the coming weeks, read on good people.

Overview

Redacted and its ecosystem and community has grown so much since launch. With the protocol and the peripheral structures finding their product-market fits, there are so many moving parts and things to synchronize. After many hours of work and testing, the Core Team is now officially ready to release v2. This means a more sustainable reward mechanism, as well as a more usable token for the future of the protocol. Utilities of the v2 BTRFLY token will allow Redacted to share the yield realized by the protocol and the revenue generating products built on top of it. Exciting times are here now, and if you are reading this, you are on time!

How does rlBTRFLY work?

Revenue Locked BTRFLY or rlBTRFLY is basically a staked version of the erc20 v2 BTRFLY (think CVX style locker) and users will be able to lock their tokens into the protocol in 16-week intervals. Depositors will receive a percentage of the revenue for the timeframe the tokens are locked into the contract. The epochs begin every Thursday at 00:00 UTC.

It is recommended that deposits are made before the beginning of an epoch, as deposits made later will not receive rewards until the next epoch starts. All the BTRFLY locked prior to the weekly epoch will share the same unlock date that reflects the start of the epoch +16 weeks. Be advised (!),tokens that unlock after 16 weeks will need to be relocked to qualify for subsequent rewards.

Why the transition?

At launch, Redacted utilized the treasury funding mechanisms designed and implemented by OlympusDAO. The “rebase” style token gave users of the protocol the ability to bond tokens found desirable to the treasury in return for discounted v1 BTRFLY tokens. Once these tokens were locked, they would receive rebase rewards coinciding with the current Index number (i.e. if you bought 1 BTRFLY at launch, the amount of rebase rewards you would have would match the index number).

While the bonding mechanism pioneered by Olympus was highly effective in the Protocol's early phase and enabled Redacted to bootstrap the Treasury, over the long term, concerns about dilution and a focus on revenue generation motivated the team to pursue a new tokenomics model. Hence, the new v2 BTRFLY token implementation.

The below section outlines how revenue sharing will be performed for each of the protocols current sources of revenue:

Important Dates

August 8th - V2 Migration is live! LFG. Users can head to the Redacted.finance website and bring their BTRFLY, xBTRFLY and wxBTRFLY to be burned for the new v2 BTRFLY and then lock them into rlBTRFLY. Holders will be reminded daily, across all platforms, to do this with their bags and lock to qualify for the 1st round of rewards. As an added bonus, instead of 2 weeks of rewards, the 1st epochs rewards have been accumulating since the 1st of June, boosting the rewards on this first epoch!

August 10th/11th - Tokens must be locked into epoch 0 by MIDNIGHT UTC! 00:00

*Be aware as to your timezone and how it converts if close to the deadline*

To learn more, please visit the new blog post on v2 Migration and rlBTRFLY.

Note: v2 BTRFLY will have its own (new) token contract!! Watch out for SCAMS and weird messages. Please remember that Redacted WILL NEVER CONTACT YOU THROUGH DMS.

Only interact with verified contracts and only use pools that you trust. This cannot be stressed enough.

What are the benefits to rlBTRFLY?

As stated above, rlBTRFLY allows lockers access to the revenue streams of the protocol and the products built on top of it. In addition to earning rewards, rlBTRFLY lockers will also be eligible to vote on Snapshots, so holders can still take part in protocol governance and decision-making in the Redacted community and ecosystem.

Oh, and did we mention that rlBTRFLY rewards are allocated in ETH!!!

In the interest of optimizing rewards, the community passed the proposal that rlBTRFLY rewards be paid in ETH (instead of stables, or small amounts of each reward token generated) which could have caused smaller investors problems with having to sell multiple tokens for ETH or stables anyway.

In addition to the revenue sharing described above, rlBTRFLY holders will also receive additional BTRFLY incentives for at least the first year of locking. Providing these incentives not only rewards early believers in the protocol, it also allows the core team to supplement rlBTRFLY distributions while products are developing and growing market share.

These distributions have received an allotment of 7% of the total BTRFLY supply to rlBTRLFY lockers in the first year and the incentives will be front loaded, so that early lockers are rewarded more than the ones who came late to the party.

v1 to v2 metrics

*v1 tokens will always be redeemable for v2 BTRFLY. However, v1 BTRFLY, xBTRFLY and wxBTRFLY will no longer be rebased. The BTRFLY v1 index will become fixed with BTRFLY v2 launch.*

Partnership Updates

dAMM

dAMM put forth a proposal to Redacted that passed by a tight margin.

The brief overview is that the Redacted treasury will make a 500k deposit into the dAMM BTRFLY Pool, allowing market makers access to directly borrow, and provide liquidity across all $BTRFLY markets. $BTRFLY earns a source of reliable revenue to the treasury.

dAMM is an uncollateralized lending protocol incubated from System9. Any token with a liquidity pool on dAMM has algorithmically determined interest rates, where market makers and investors can borrow on the platform. They do this to provide liquidity and trade across all centralized and decentralized trading venues.

All users and community members can deposit into the BTRFLY pool and supply additional liquidity for market makers, and earn rewards. The team at dAMM have more of a dao focused scope (as compared to traditional VC with big allocations and the ability to dump), and they look to add to protocols and their liquidity.

Additionally a retro-active airdrop is planned for all DAO’s and token issuers that contribute their native assets to dAMM and this qualifies for that airdrop. Listen to the CC recorded with them and the core team to get caught up.

Pirex Updates

Pirex is getting bigger everyday. It now has a whopping 868k CVX with a TVL of $6.1M at the time of writing.

Pirex deposit bot (Hotwheels)

A new bot by Hotwheels is found under the Pirex section in the Discord server under deposit-tracker.

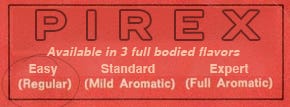

Standard Mode

With the release of Standard Mode on Pirex, users can enjoy a very similar experience to locking their tokens up with Convex, but with more usability. Most importantly, depositors receive a liquid token, pxCVX which grants the ability to redeem locked assets. With Pirex you can withdraw the underlying assets, but the intention however is to make the platform lucrative enough that the user won't want to.

Pirex focused Twitter Spaces

Hidden Hand

Hidden Hand has been increasing in volume since launch. Done up by Funkybot, there is a new analytics page on Hidden Hand on Dune. Head over to keep track of the bribe volume.

Recently, the core team rolled out their new delegation functionality for Hidden Hand, as projects who have delegation enabled on their token launch their hidden hand markets, we will add this feature to their market starting with Aura.

Hidden Hand Bribe-Bot

Discord and Twitter have a new bot among us. The Hidden Hand bribe-bot tracks bribes that are posted on the platform so everyone can stay up to speed… Follow the bot on Twitter at https://twitter.com/hiddenhandbot to get notifications of new bribes.

Podcast

In this episode of Redacted Wiretap, fellow core team members 0xKolten, 0xOmnia and Magnus talk about the state of the market at the time of the episode recording. We chat about some Project Updates like rlBTRFLY, our thoughts on veTokenomics and how NFT Bribes on Hidden Hand came about.

In this episode of Redacted Wiretap, fellow core team members 0xOmnia and Magnus talk to their special guest Small Cap Scientist. They cover how SmallCap got his start in the space, as well as about Pirex merch, and the next milestones and market growth for Hidden Hand & Pirex.

They also talk about the recently released Q2 Report and how it pertains to life in Redacted.

Bonus content with the things Smallcap is excited about in the DAO space.

Community Updates

Resident Core Team member 0xOmnia has written a great piece on Cracking the Code of the NFT Flywheel now available to both read and collect on Mirror. The article goes through the Current Problem with NFT Collections, and why bribes and liquidity are important to realize the final iteration of financializing NFTs and completing the flywheel. Available NOW.

Contributors: EthHunter, Molecul, The Psych Guy, Boxy

“Time Flies In BTRFLY”